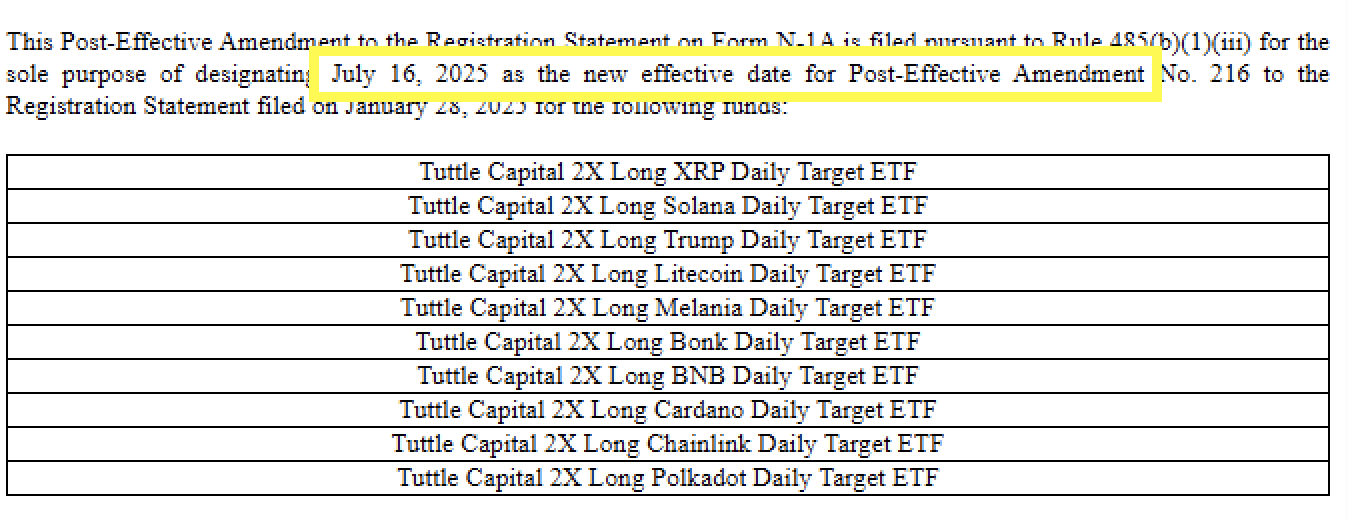

Tuttle Capital has announced a new effective date for the launch of several cryptocurrency-focused exchange-traded funds (ETFs). The new date, set for July 16, 2025, applies to a series of 2x leveraged ETFs targeting XRP, Solana, Trump, Litecoin, Bonk, BNB, Cardano, Melania, Chainlink, and Polkadot.

Tuttle Capital’s Launch Date for XRP, Solana, BNB, Trump, ADA ETF

According to Bloomberg analyst Eric Balchunas, Tuttle Capital filed a post-effective amendment to the Registration Statement for a variety of crypto-related ETFs.

The new amendment designates July 16, 2025, as the effective date for a series of funds, including the Tuttle Capital 2X Long Daily Target ETFs for XRP, Solana, Trump, Litecoin, Bonk, BNB, Cardano, Melania, Chainlink, and Polkadot.

Despite marking an official date by the amendment, this does not imply that these ETFs will be instantly launched. In the past, effective dates in the filing of ETFs have been considered an indicator that it is ready to be listed in markets, but it may take regulatory or market-related delays before the ETFs are officially launched. As Eric Balchunas pointed out, the new date suggests a potential move towards launching these ETFs soon following footsteps of Canada’s 3 spot XRP ETF’s approval in June.

Impact of the $SSK Solana ETF Launch

The announcement of the new effective date for Tuttle Capital’s cryptocurrency ETFs comes on the heels of the anticipated launch of the Rex-Osprey Solana Staking ETF ($SSK), which is scheduled for launch tomorrow. The ETF will also be the first such product to stake Solana tokens in the U.S. and is likely to be of interest to investors interested in exposure to Solana via an exchange-traded instrument.

Analysts believe the success or failure of the $SSK launch could prove influential in determining the timeliness and success of other crypto ETFs.

The approval of the $SSK ETF at the U.S. Securities and Exchange Commission (SEC) has led to some controversy according to the manner in which it was approved. In contrast to other ETFs, the $SSK was not officially sanctioned by the SEC rather, it was the non-opposition which permitted it to become available. This has left the industry worrying about the regulatory framework surrounding cryptocurrency-based products.

Nevertheless, with the introduction of the Rex-Osprey Solana ETF, it could be a baby step toward the overall reception of cryptocurrency ETFs in the US market. Experts believe that there is a high probability of 95% that the SEC can in the upcoming months approve ETFs on other spot-based assets including Litecoin (LTC), Solana (SOL), and XRP.

Tuttle Capital’s Focus on Leveraged Crypto ETFs

The Tuttle Capital funds are based on 2x leveraged ETFs, providing a special investment opportunity especially to those who want to get more out of the cryptocurrencies.

The funds are to offer investors with a means to take advantage of price fluctuations in cryptocurrencies such as XRP, Solana, Trump, Litecoin, Bonk, BNB, Cardano, Melania, Chainlink, and Polkadot on a day-to-day basis. These ETFs have a leveraged structure, that is, they will seek to deliver two times the daily performance of their underlying assets.

With cryptocurrencies experiencing volatile price fluctuations, leveraged ETFs can appeal to traders who want to amplify their returns on a short-term basis. However, they also come with increased risk, especially during periods of high volatility.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.