- Arca divests all Circle shares due to IPO allocation. Market influence noted.

- Circle’s IPO raised $1.05 billion.

- USDC sentiment potentially impacted by fund’s decision.

Jeff Dorman, Arca’s Chief Investment Officer, announced on social media that Arca sold all Circle shares after receiving an insufficient IPO allocation. This action reflects dissatisfaction with Circle’s preference for traditional finance firms.

The divestment emphasizes ongoing tensions in crypto vs. traditional finance interests, despite Circle’s IPO success raising $1.05 billion. Immediate shifts in institutional sentiment surrounding Circle’s stablecoin, USDC, may result.

Arca’s Complete Exit Sparks Tensions with Traditional Finance

Arca announced the sale of all its shares in Circle after Jeff Dorman highlighted perceived favoritism towards traditional financial firms in Circle’s IPO allocations. Earlier critical comments were made regarding allocations, as Arca received $135,000 worth of Circle shares against a $10 million order. Jeff Dorman, Chief Investment Officer, Arca, criticized Circle’s IPO allocation, stating: “You decide to give fat allocations to TradFi mutual funds and hedge funds who likely didn’t even read your prospectus, have no wallets, and will never use your product.”

Impact includes the potential shift in sentiment around USDC, as Arca has publicly considered turning to USDT instead. This event may influence stablecoin preferences among other institutional investors.

Market reactions were swift, with

significant attention. There has been no public response from Circle’s leadership as of the latest reports. The newly traded CRCL shares performed strongly, reaching $90, despite Arca’s exit.

Circle’s IPO Allocation Controversy: Insights and Future Implications

Did you know? The allocation issue between Circle and Arca mirrors past IPO events where crypto-native funds faced disadvantages against traditional finance entities.

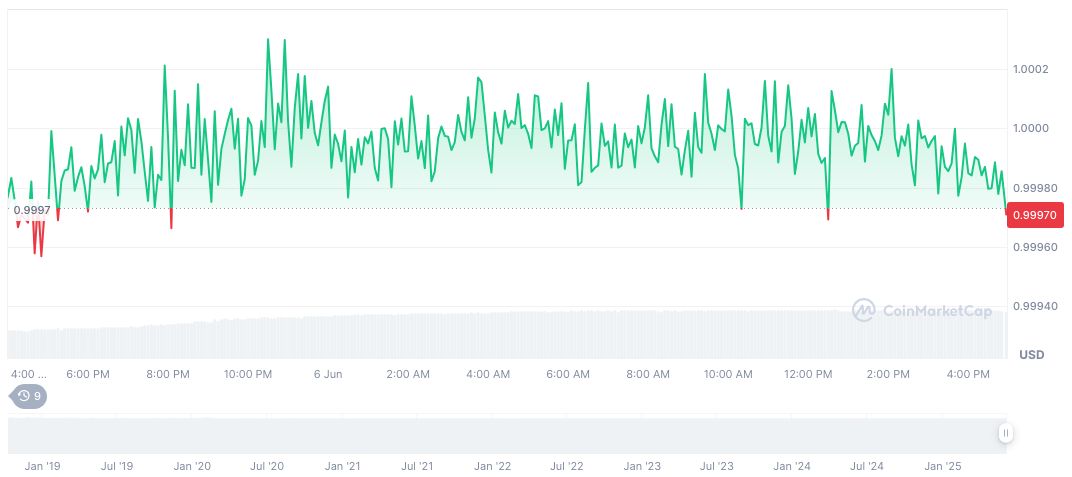

USDC’s current market cap stands at $61.12 billion, with a market dominance of 1.88%, according to CoinMarketCap. Trading volume decreased by 24.96% over the past 24 hours. Price changes show slight volatility, with a 1.02% drop in 24 hours but a slight upward trend over 90 days, showing a 0.55% increase.

Insights from Coincu research suggest this event could provoke a reassessment of allocation strategies in future crypto-related IPOs. Regulatory trends might not radically alter standards immediately, but long-term views could favor greater inclusivity in allocations, considering ongoing pressures to acknowledge crypto-native participants in fundraising activities.