- Hong Kong gazettes Stablecoin Ordinance, impacting HKD-pegged stablecoins.

- Only licensed institutions can issue or sell stablecoins.

- Law aims to bolster public and investor protection.

The Hong Kong government gazetted the Stablecoin Ordinance on May 30, 2025, ushering it into law to regulate stablecoins in Hong Kong.

This new regulatory framework mandates licensing for HKD-pegged stablecoin issuers, aiming to enhance public and investor protection in the digital asset market.

Licensing Regime Enforced for HKD-Pegged Stablecoin Issuers

Hong Kong’s Stablecoin Ordinance establishes a licensing regime for issuers of stablecoins anchored to the Hong Kong dollar. Only licensed institutions are permitted to issue or sell these stablecoins in Hong Kong. The Hong Kong Monetary Authority emphasizes strengthening investor protection and combating fraud through strict compliance requirements.

Issuers must manage reserves and adhere to anti-money laundering standards. Acceptance of stablecoin advertisements is restricted to licensed issuers. This measure is designed to prevent fraudulent schemes and ensure the stability of fiat-referenced stablecoins in the market.

“The regulatory regime will provide better protection for the general public and investors… only specified licensed institutions may offer an FRS in Hong Kong, and only an FRS issued by a licensed issuer may be offered to a retail investor. Additionally, to prevent fraud and scams, at all times (including the six-month non-contravention period), only advertisements of licensed FRS issuance are allowed.” — Government of Hong Kong, Official Spokesperson

Hong Kong’s Stablecoin Move Echoes Global Regulatory Models

Did you know? Hong Kong’s regulatory approach to stablecoins echoes strategies in Singapore and the EU, emphasizing compliance with reserve and AML standards.

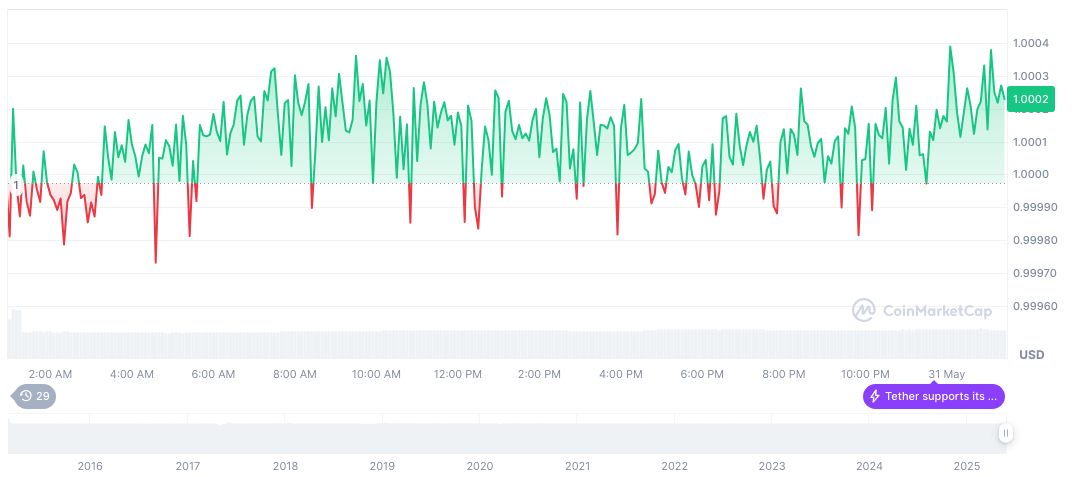

Tether USDt (USDT) is currently priced at $1.00, holding a market cap of 153.07 billion dollars and a market dominance of 4.70%. With a 24-hour trading volume of 98.96 billion dollars, it has experienced small price changes: 0.03% in the past 24 hours and 8.31% over 90 days, according to CoinMarketCap.

Coincu research suggests that Hong Kong’s framework creates a model for other jurisdictions aiming to regulate digital assets. It signifies a pivotal shift towards comprehensive oversight, potentially increasing investor confidence and market stability.

Source: https://coincu.com/340785-hong-kong-stablecoin-ordinance/