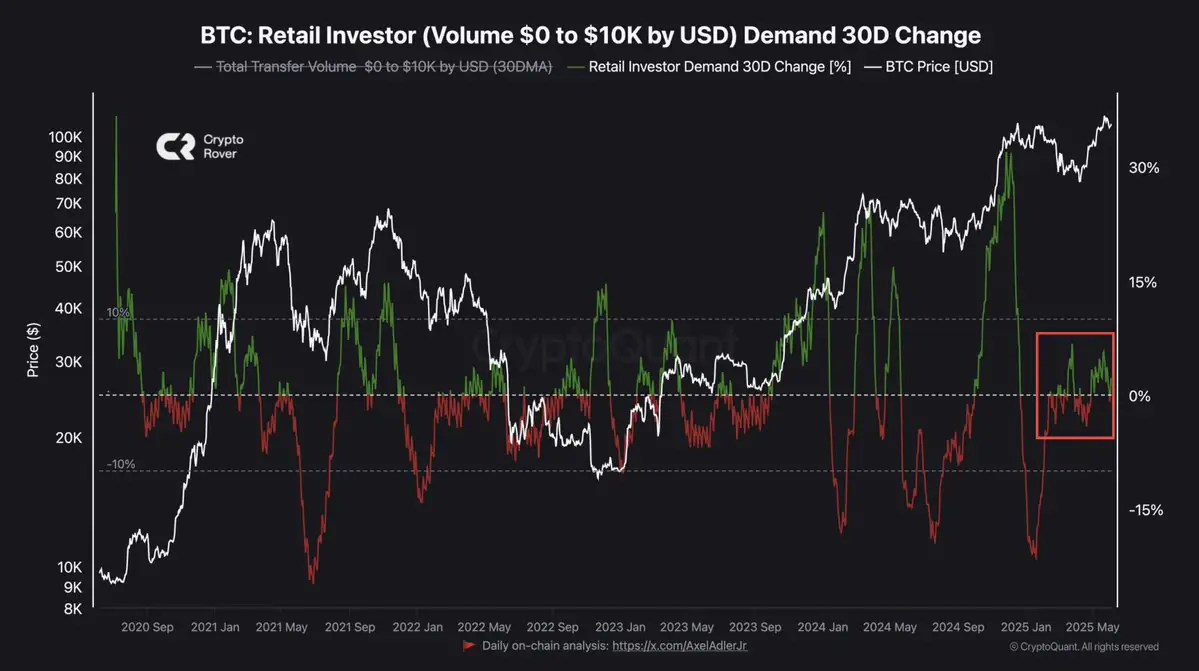

Crypto analyst Crypto Rover pointed to a striking divergence in Bitcoin’s market dynamics: retail investor demand remains subdued despite BTC nearing new highs.

According to data from CryptoQuant, the 30-day percentage change in BTC demand from retail participants—those transacting with $0 to $10,000—has remained flat or negative in recent months.

This suggests smaller investors are not yet returning in force, a stark contrast to previous bull cycles where retail enthusiasm was a major driver of parabolic moves.

The chart, shared by the analyst, highlights how retail activity (red and green lines) remains muted even as BTC price (white line) climbs above $70K. This disconnect could signal that the current rally is still institutionally driven, leaving room for further upside if retail eventually joins in.

Bitcoin Cycle Nearing Its Climax?

Meanwhile, MerlijnTrader emphasizes that each Bitcoin bull market has historically lasted longer, with bear markets becoming shorter. Drawing from previous cycle data, he notes that Bitcoin topped out in November–December during the 2013, 2017, and 2021 cycles.

We are currently 15 months into the present cycle, and if history repeats, a potential peak could be due in six months—right around November–December 2025.

His chart shows that the ongoing bull market has lasted 517 days so far, outpacing the 369-day run in 2020–2021. If the pattern holds, we may be entering the final—and possibly most explosive—phase of this bull run.

Key Takeaways

- Retail missing: On-chain data shows little participation from small investors, a potential fuel source for future upside.

- Cycle maturity: Historical trends suggest a November–December top, aligning with past cycle peaks.

- Strategic timing: Traders should watch for signs of retail FOMO as a late-cycle indicator.

As institutions continue to dominate, the next wave of retail interest could trigger a final price surge. Investors would be wise to prepare as the window narrows.

Source: https://coindoo.com/market/retail-hesitant-as-bitcoin-cycle-matures-analysts-highlight-divergence/