- U.S. President Trump urges rate cuts during Federal Reserve HQ visit.

- Trump’s call increases scrutiny on monetary policy and financial decisions.

- Financial markets watch Fed’s potential moves following Trump’s visit.

On July 25th, President Trump visited the Federal Reserve in Washington, D.C., marking the first presidential visit in nearly two decades, and emphasized the need for lower interest rates.

The visit highlights ongoing tensions between Trump and Fed Chairman Powell, potentially impacting future Federal Reserve interest rate decisions.

Trump Urges Rate Cut Amidst Budget Overrun Critique

President Trump visited the Federal Reserve headquarters and urged Chairman Powell to consider a rate cut. Highlighting the $2.5 billion renovation costs, Trump criticized budget overruns. “I would fire a project manager who goes over budget.” The interaction between both leaders underscores ongoing tensions at the institution.

Trump’s call for an interest rate cut has reignited debates about the Fed’s policy direction. Akin to previous encounters, Trump’s remarks put pressure on Powell, potentially influencing upcoming monetary decisions. Such public exchanges highlight the intersection of political and financial policy during Trump’s tenure.

Reactions to Trump’s visit were notable, with Powell maintaining restraint despite Trump’s demands. Powell assured continuous evaluation of economic conditions before deciding on any rate changes. The event has left financial markets speculating about future Fed meetings and policy adjustments.

Historical Context, Price Data, and Expert Analysis

Did you know? During previous administrations, direct presidential intervention in Federal Reserve decisions has led to crisp financial market fluctuations, echoing older patterns of political influence on economic governance.

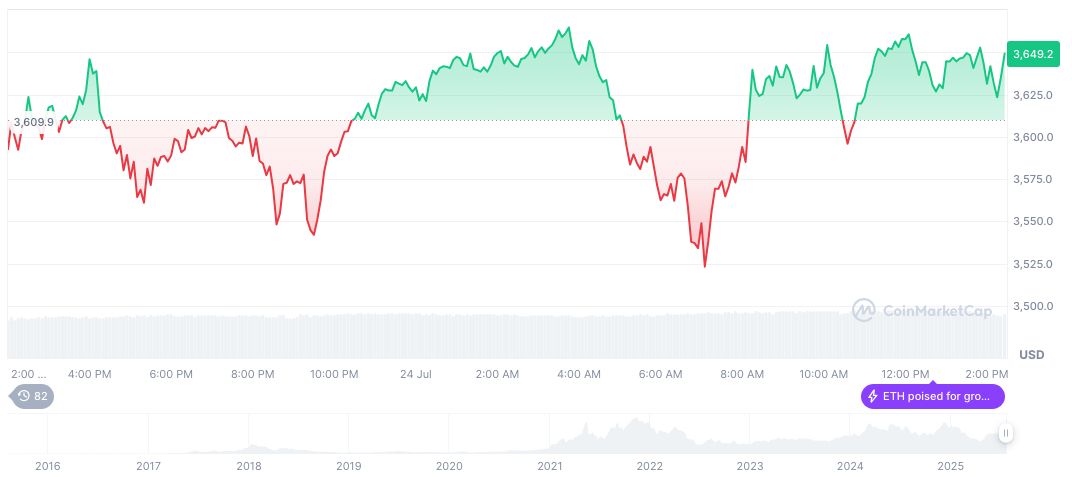

Ethereum (ETH) stands at $3,705.70 with a market cap of $447.32 billion, according to CoinMarketCap. ETH’s recent uptrend shows a 2.17% rise over 24 hours and a substantial 107.11% increase over 90 days. The asset’s trading volume hit $40.88 billion, reflecting dynamic investor interest and market activity as of July 24.

The Coincu research team identifies a potential increase in volatility in financial markets if Fed actions align with political demands. Historical data suggest short-term reactions, but sustained impacts depend on formal policy shifts. The cryptocurrency sector may remain insulated unless broader economic policies veer toward more drastic changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |